Finance Fest a success

Bob Gillingham, or Mango Bob, discusses the emotional cycle that can interfere with investments at Finance Fest on April 25. Students were able to eat dinner and attend sessions to learn about finance.

April 30, 2019

Chris Conklin discusses credit at Finance Fest on April 25. Students were able to eat dinner and attend sessions to learn about finance.

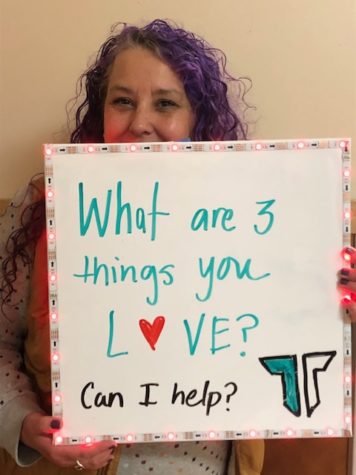

Business teacher Sue Suttich, in collaboration with FinMango, held Tigard High’s first “Finance Fest” last Thursday. The three-hour event was open to all and comprised of various informational sessions which promoted an understanding of personal finance and investing.

Over 150 students and parents gathered in the school cafeteria for the Finance Fest.

“I think it was a great turnout,” Suttich said. “I got a lot of great feedback from it.”

The business department ordered pizzas and Panda Express to feed the hungry attendees as they listened to guest speakers Scott Glasgow and Bob Gillingham of FinMango, a global nonprofit that serves to combat poverty by teaching students the basics of financial literacy.

The night ended with a raffle hosted by OnPoint Community Credit Union.

Suttich first heard of FinMango through a financial literacy Facebook group and invited them to visit Tigard High soon after. The organization is fairly new; Scott Glasgow founded FinMango two years ago in Ohio. Glasgow, also known as “Mango Scott,” realized the importance of financial understanding during the Great Recession, when he was still in high school.

“Financial illiteracy is the crisis of our lifetime that no one knows about,” Glasgow said to the audience on Thursday. As a high school student, he aspired to learn more about personal finance especially so he could fare better with his financial situation than his parents.

His dad, Glasgow says, was well-educated in his career field but poor at handling money.

“Poverty is a big puzzle,” he said. “Financial literacy is one of the pieces to that puzzle.” Understanding how money works in the first place is a simple yet crucial step toward financial success.

Glasgow found himself inspired to educate as many others as possible so that they could start off on the right foot post-graduation, and so began his mission.

But money can be a difficult subject for many to talk about. Glasgow acknowledged this and wanted a symbol for his organization that would express positivity and enthusiasm.

“I’m a bright and energetic person, and money can be a dark subject, so I wanted something bright and colorful,” Glasgow said. Ultimately, he settled on the familiar juicy fruit to represent his team. The name “FinMango” is an amalgamation of “financial management” and “mango.”

Bob Gillingham or “Mango Bob” is one of the executive directors of FinMango. Gillingham is a self-made millionaire and, like Glasgow, his financial journey was largely influenced by the recession. At the time, Gillingham had $680,000 invested in stocks, which dropped to less than $400,000 in 2008.

But rather than selling his shares and saving his funds from further downfall, he chose to keep his money in the market through the recession—and with that simple decision, the value of his stocks not only rose back up by 2009 but eventually jumped to $5 million, far exceeding the amount he had originally invested. The biggest obstacle for most inexperienced investors, according to Gillingham, is having to overcome the fear of temporary loss and focus instead on the long-term growth of the stock market.

“[People] let their emotions interfere with their investment decisions,” he said. At the Finance Fest, Gillingham discussed the emotional cycle that drives people toward “buy-high-sell-low” (which only guarantees net loss) as well as other common pitfalls that people can fall into when chasing quick gains, like investing in startups and hoping for the best.

Bob Gillingham, or Mango Bob, discusses the emotional cycle that can interfere with investments at Finance Fest on April 25. Students were able to eat dinner and attend sessions to learn about finance.

“Kids tend to look at penny stocks as opportunities,” he said. “I see them as landmines.” Throughout his presentation, Gillingham made a point to reiterate that the stock market is a tool for eventual success, not immediate reward. Earning high reward is possible, but it requires early action and self-discipline. The earlier one invests and the longer they keep their money invested, the more they will have in the future.

“You can all become millionaires just by starting early,” Gillingham said. He finished off his speech by recommending a simple way for all teens to start investing: open up a Roth IRA with at least $100 in an S&P 500 index fund, make further contributions at regular intervals, and wait.

Time is a valuable asset, and every high schooler has plenty of it. The Finance Fest was an incredible opportunity for all students to learn of the easy path to success that is within their reach if they are willing to learn and take those first steps.